sales tax on leased cars in virginia

Three percent through midnight on June 30 2013 four percent beginning July 1 2013. What Is The Property Tax For Vehicles In Virginia.

Ferrari F12 Berlinetta Ferrari F12berlinetta Ferrari Berlinetta Ferrari F12

In addition to taxes car purchases in Virginia may be subject to other fees like registration title and plate fees.

. Tax Rates For most passenger vehicles the motor vehicle rental tax equals 10 of the amount that you pay for the rental. In VA you are taxed up front on the cap cost of the leased car sales tax rate of 6Fairfax county and then 415 tax rate based on the value of the car each year. Virginia VA Sales Tax and Lease Purchase Option.

Some leased vehicles may qualify for Personal Property Tax Relief as provided in 581-3523 etseq. The rate is 415 but can be higher with the addition of local taxes. In Fairfax county of instance its 6.

You can find these fees further down on the page. A tax on the rental of motor vehicles in Virginia. What Does Virginia Sales Tax For Businesses Mean.

There is an average tax rate of 4 on all vehicles. Sales tax in Virginia is levied on the ENTIRE value of the car not just the depreciation as is done in most other states. The sales tax for businesses in most areas of Virginia is 53.

Virginia collects a 400 state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. Like with any purchase the rules on when and how much sales tax youll pay. Grocery items and cer tain essential personal hygiene items are taxed at.

When Driving A Leased Car In West Virginia Are You Subject To Personal Property Tax. To learn more see a full list of taxable and tax-exempt items in Virginia. In any city or county located within the Historic Triangle as defined in 581-6032 an additional one percent tax shall be imposed in addition to the tax prescribed in clause a if such vehicle is an all-terrain vehicle moped or off-road motorcycle.

Motor vehicles with a 12-month lease or lease for more will be subject to motor vehicle use tax and retail sales tax. The sales tax rate for most locations in Virginia is 53. What is the sales tax on cars purchased in virginia.

Minimum sales and use tax of 75 does not apply to all-terrain vehicles off-road motorcycles or mopeds. The Virginia Department of Motor Vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within state lines with the minimum sales tax for purchased vehicles. The rate is 415 but can be higher with the addition of local taxes.

Unless any exemption or exception is specified all sales leases and rents of tangible personal property in or for use in Virginia as well as lodgings and certain taxable services are subject to. Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75. Sales tax is a part of buying and leasing cars in states that charge it.

The tax is broken down into three parts. The motor vehicles sales and use tax is based upon the vehicles sales price or a minimum sales and use tax of 75 whichever is greater will be collected. Any person engaged in the business of leasing or renting tangible personal property to others is required to register as a dealer and collect and pay the tax on gross proceeds.

Each 100 of assessed value is. Are leases taxable in Virginia. While Virginias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

All applicable fees are due at the time of titling by the lessor such as the 15 title fee and the motor vehicle sales and use tax. Would I have to pay the full 415 sales tax for the car upfront due at signing. This page describes the taxability of leases and rentals in Virginia including motor vehicles and tangible media property.

Several areas have an additional regional or local tax as outlined below. Sales tax on leased cars in virginia. The Virginia Department of Motor Vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within state lines with the minimum sales tax for purchased vehicles.

The motor vehicle sales and use tax is due is at the time of titling the vehicle. For vehicles that are being rented or leased see see taxation of leases and rentals. The tax applies to vehicles rented for less than 12 months regardless of what type of dealer you rent it from.

In all of Virginia food for home consumption eg. Vehicles leased to a person versus a business and used predominantly for non-business purposes may qualify for car tax relief. For vehicles that are being rented or leased see see taxation of leases and rentals.

Sales leases and rentals of motor vehicles are not subject to the retail sales and use tax provided they are subject to the Virginia motor vehicle sales and use tax administered by the Department of Motor Vehicles and further provided that such tax has been paid. In addition to taxes car purchases in West Virginia may be subject to other fees like registration title and plate fees. West Virginia collects a 5 state sales tax rate on the purchase of all vehicles.

This protects people who lease from having a spike in how much they owe if state sales taxes are increased The sales tax varies by state. Id like to lease car but Ive heard different things about how you pay the sales tax when leasing a car for registration in Virginia. A lessor of tangible personal property whose place of business is outside this state and who leases or rents.

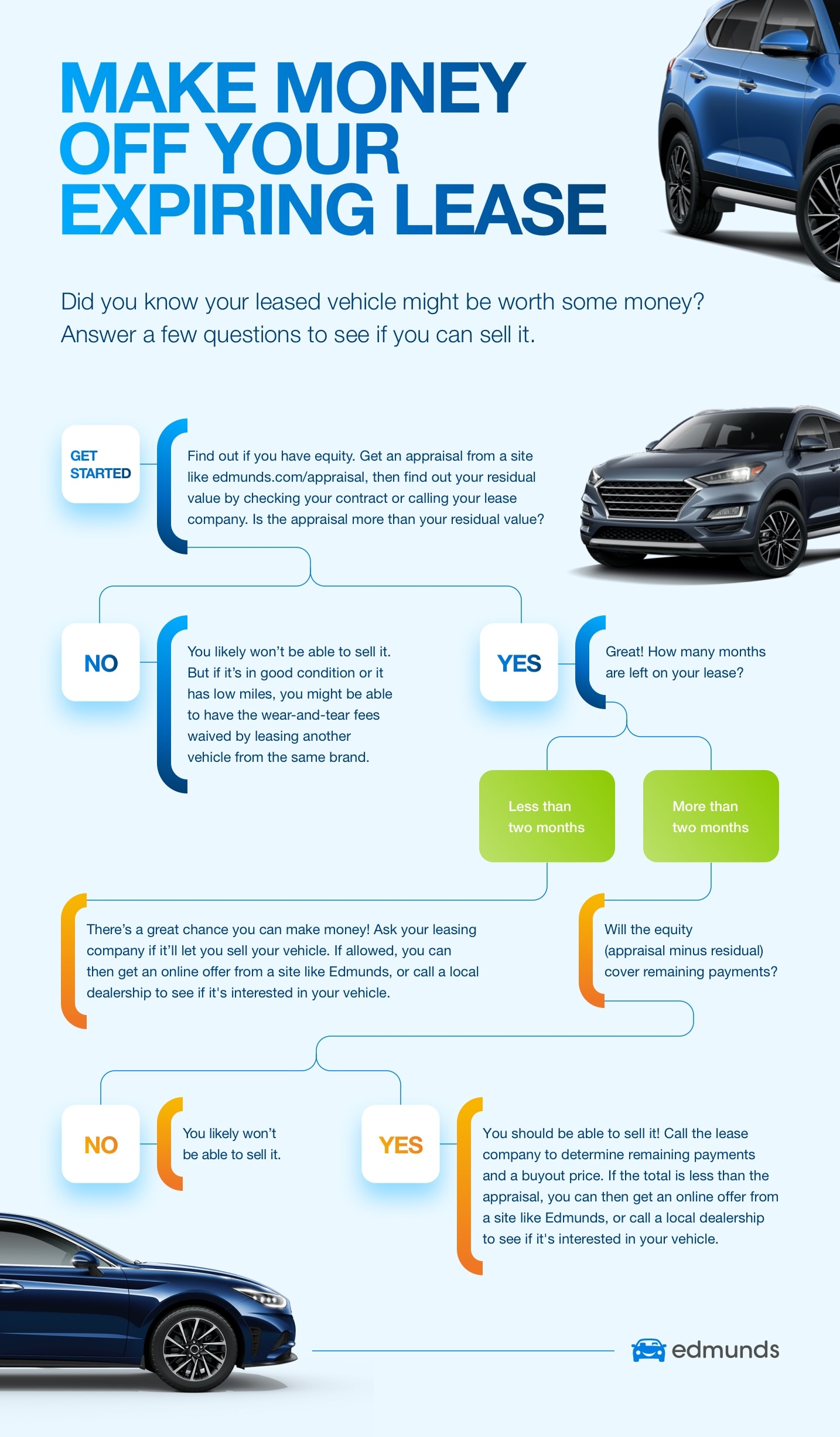

Consider Selling Your Car Before Your Lease Ends Edmunds

Do Auto Lease Payments Include Sales Tax

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

A Complete Guide On Car Sales Tax By State Shift

Which U S States Charge Property Taxes For Cars Mansion Global

Virginia Vehicle Sales Tax Fees Calculator

2012 Chrysler 200 Touring Http Www Localautosonline Com Used 2012 Chrysler 200 Convertible Touring For Sale Pensacola Fl Chrysler Cars Chrysler 200 Touring

Virginia Vehicle Sales Tax Fees Calculator

Virginia Vehicle Sales Tax Fees Calculator

Leasing Vs Buying Tax Advantages Mazda Of New Bern

Virginia Sales Tax On Cars Everything You Need To Know

Drivetime Of Miami Hialeah Fl Cars Com

Nj Car Sales Tax Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

How To Buy A Car From A Private Seller Carfax

Used Car Boom Is One Of Hottest Coronavirus Markets For Consumers

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma